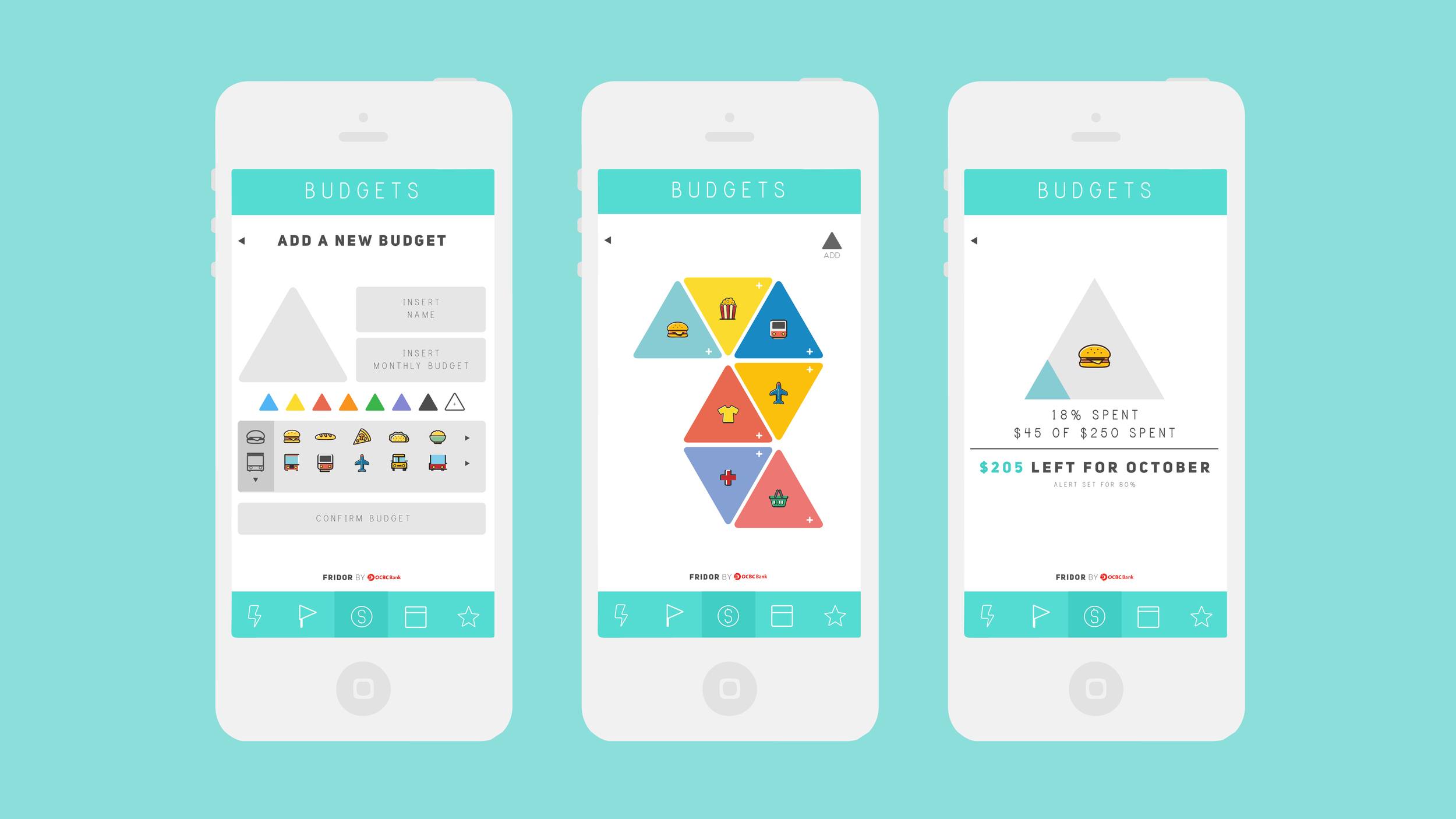

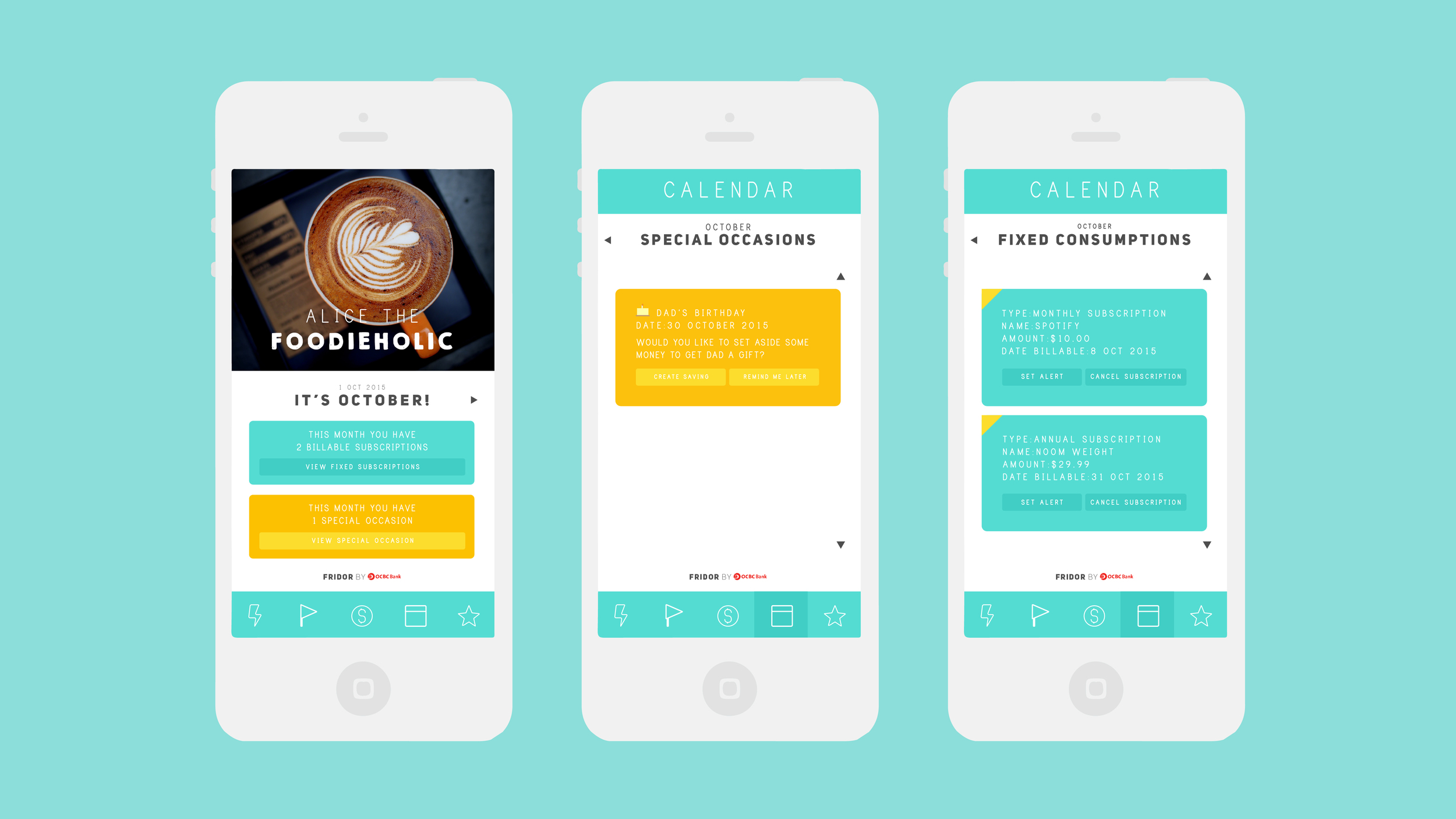

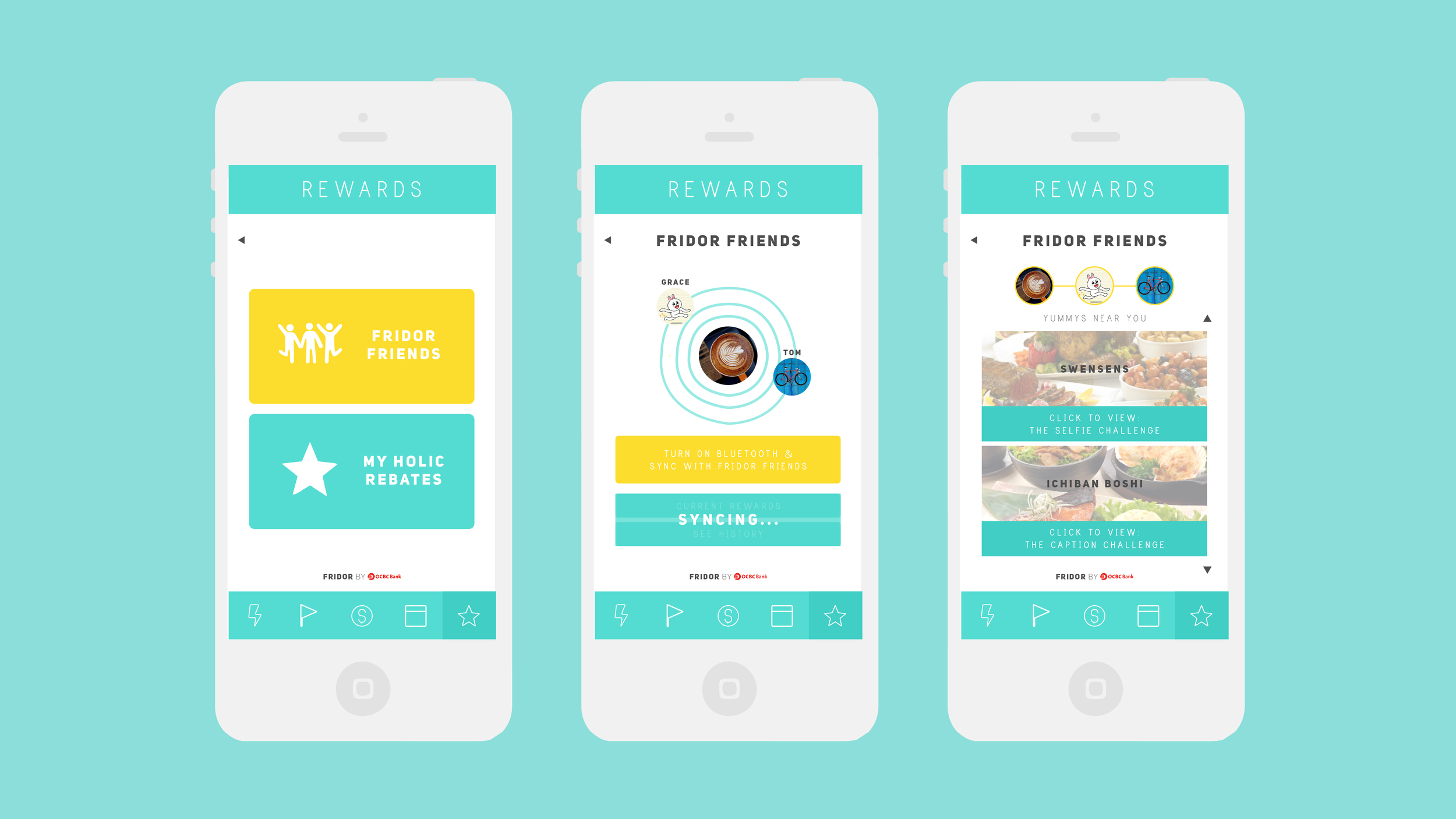

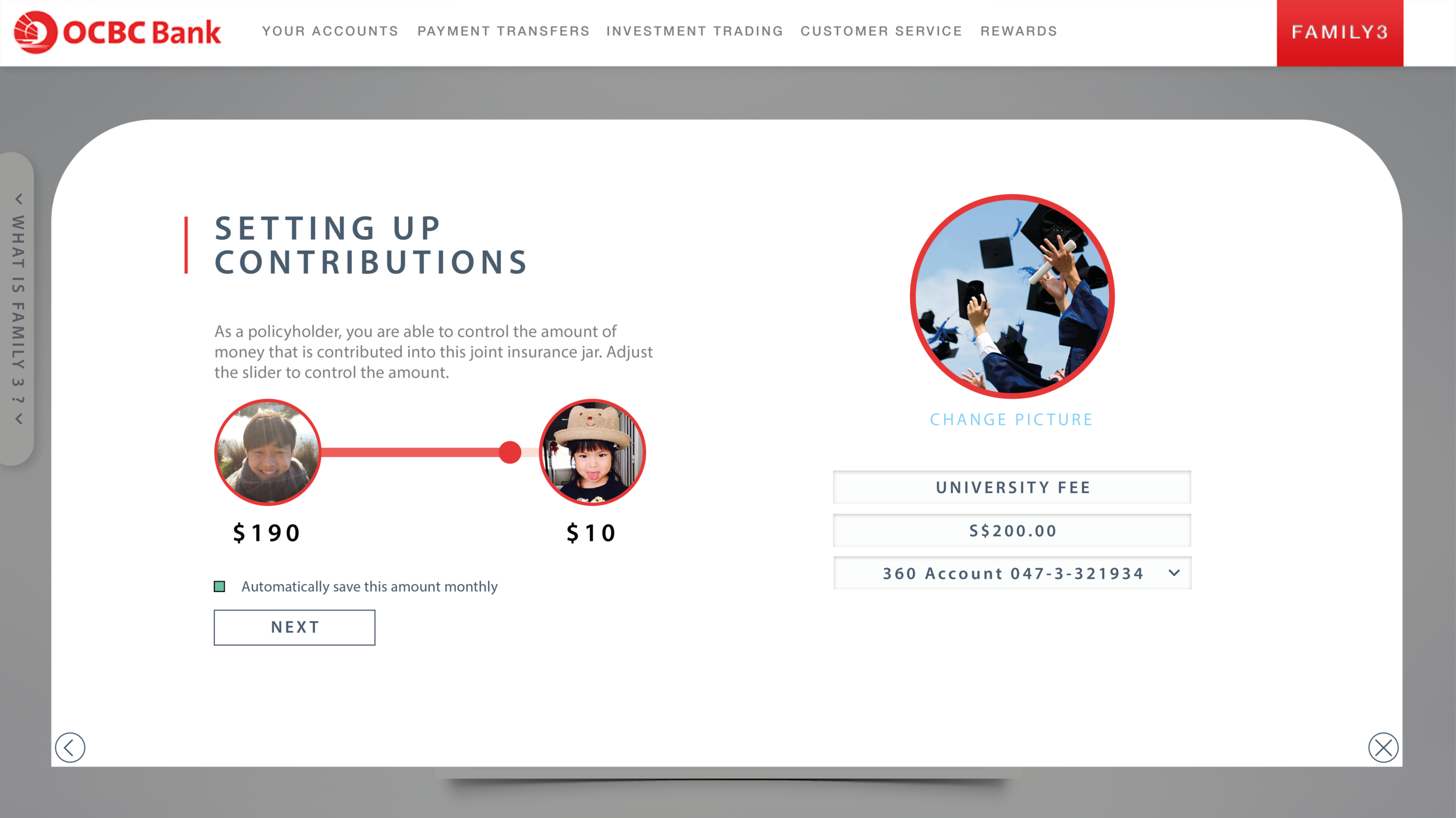

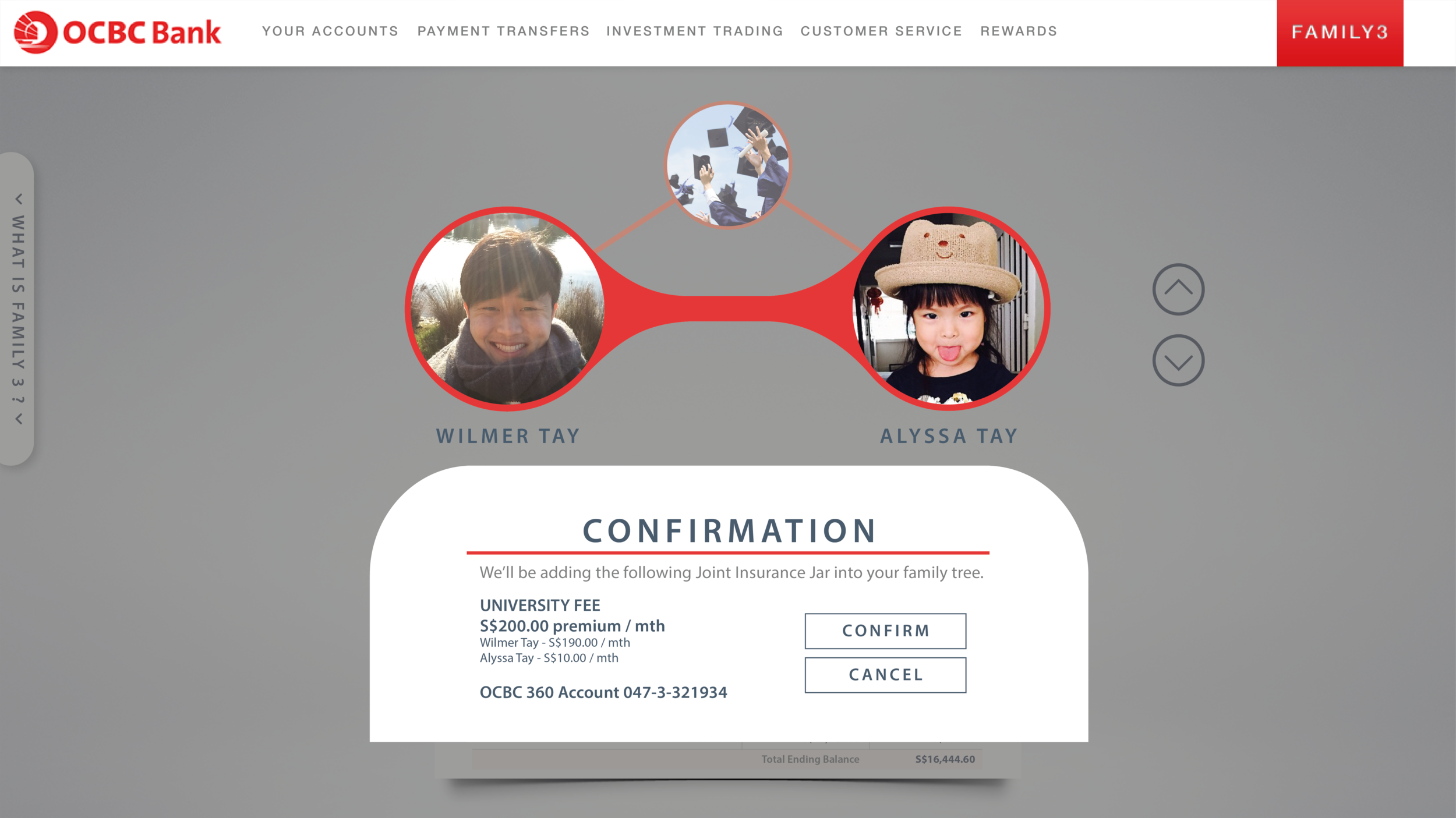

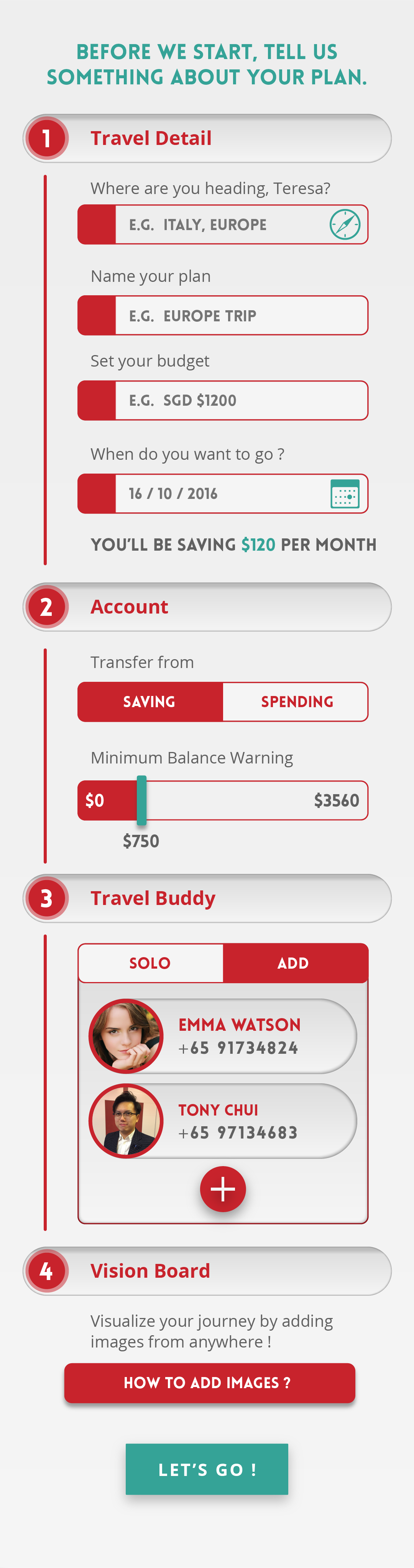

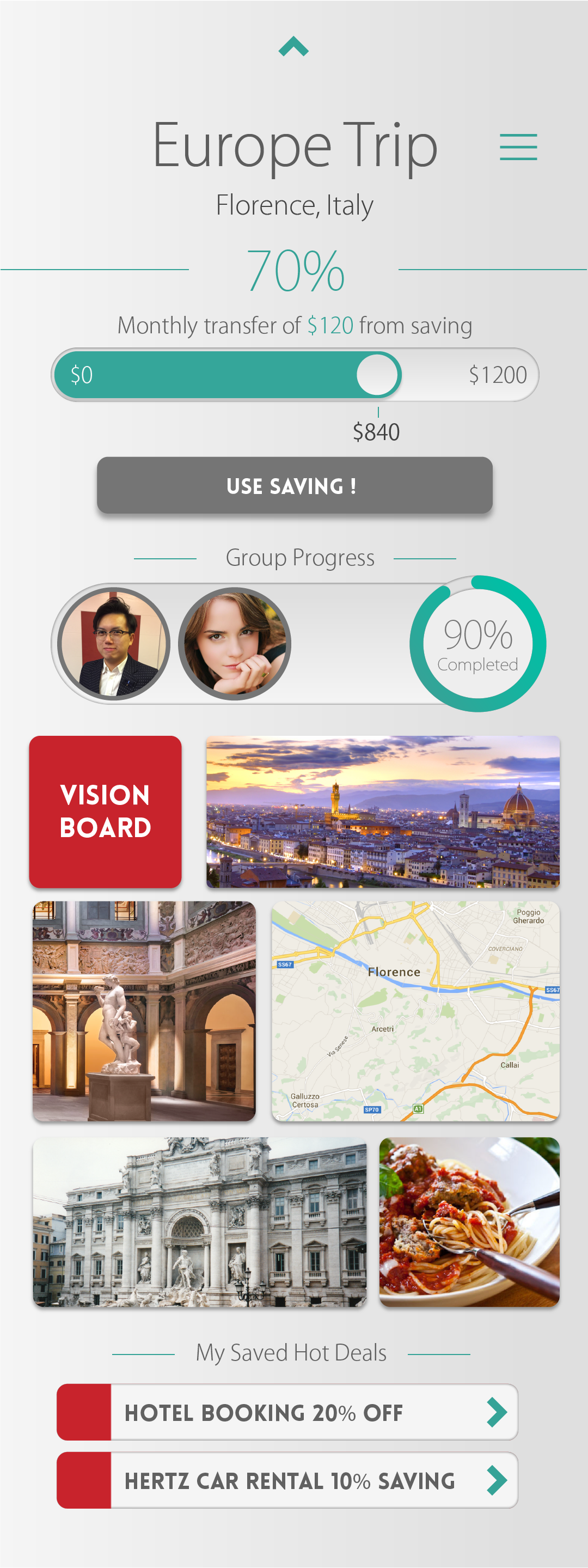

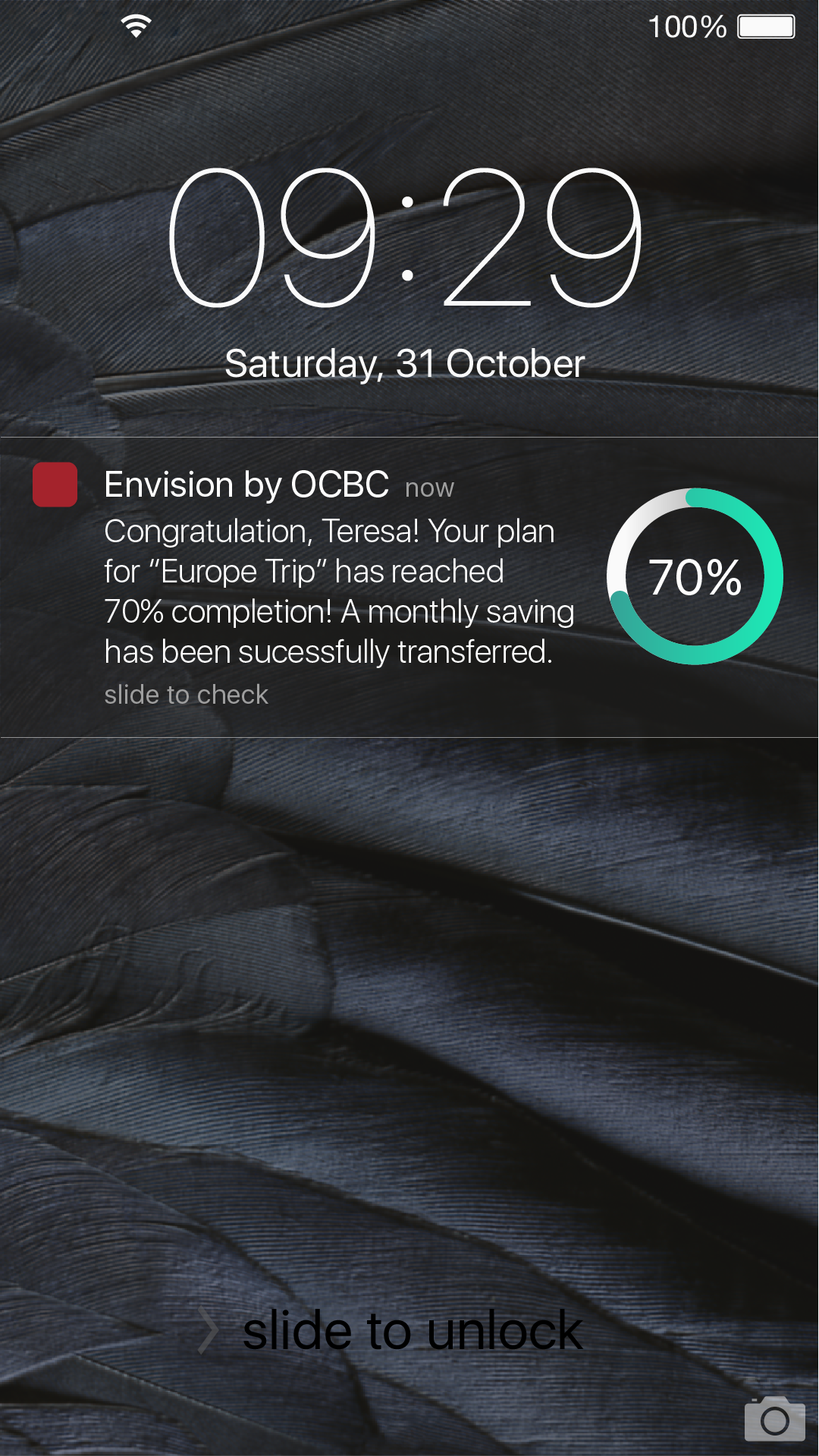

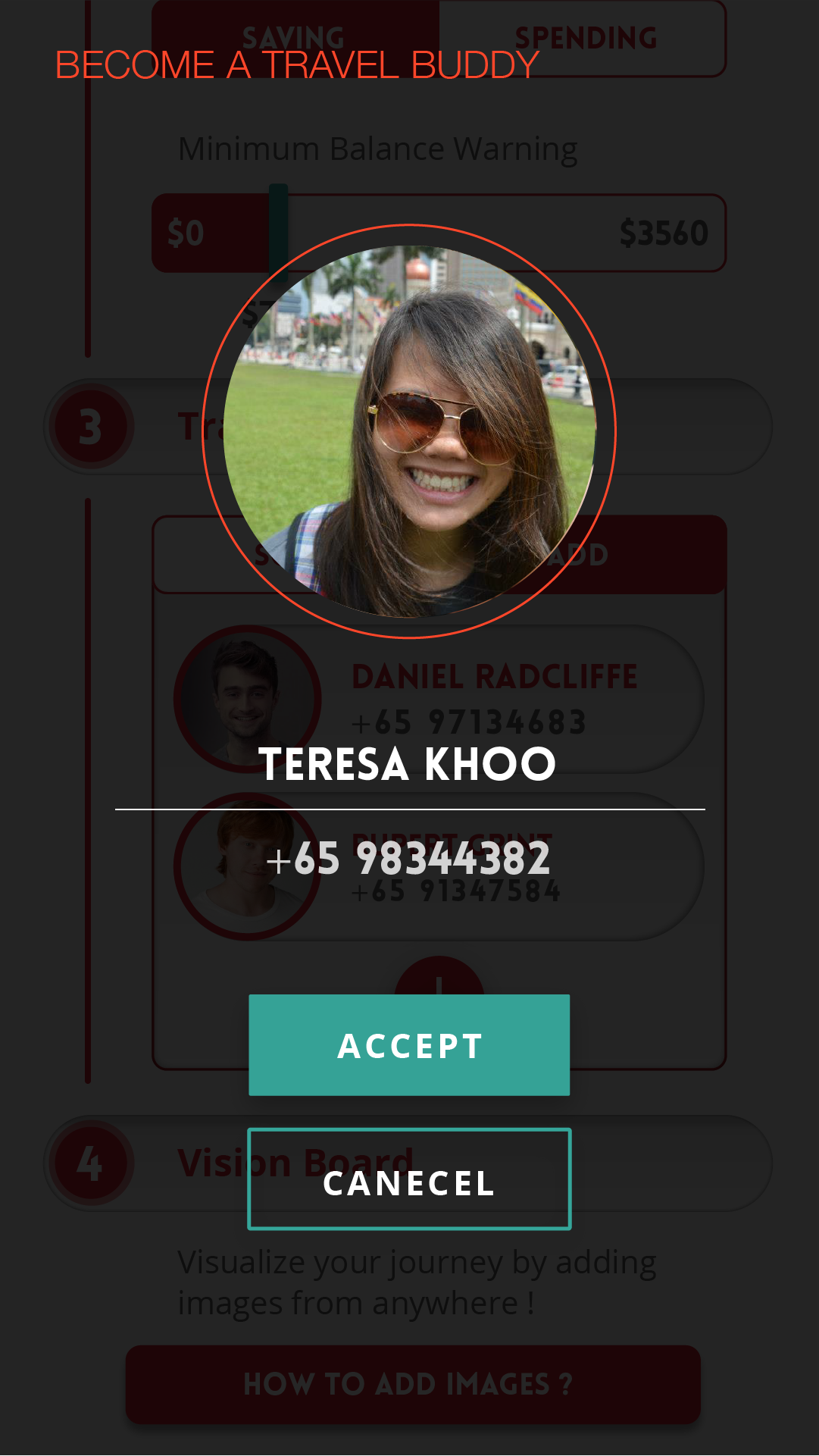

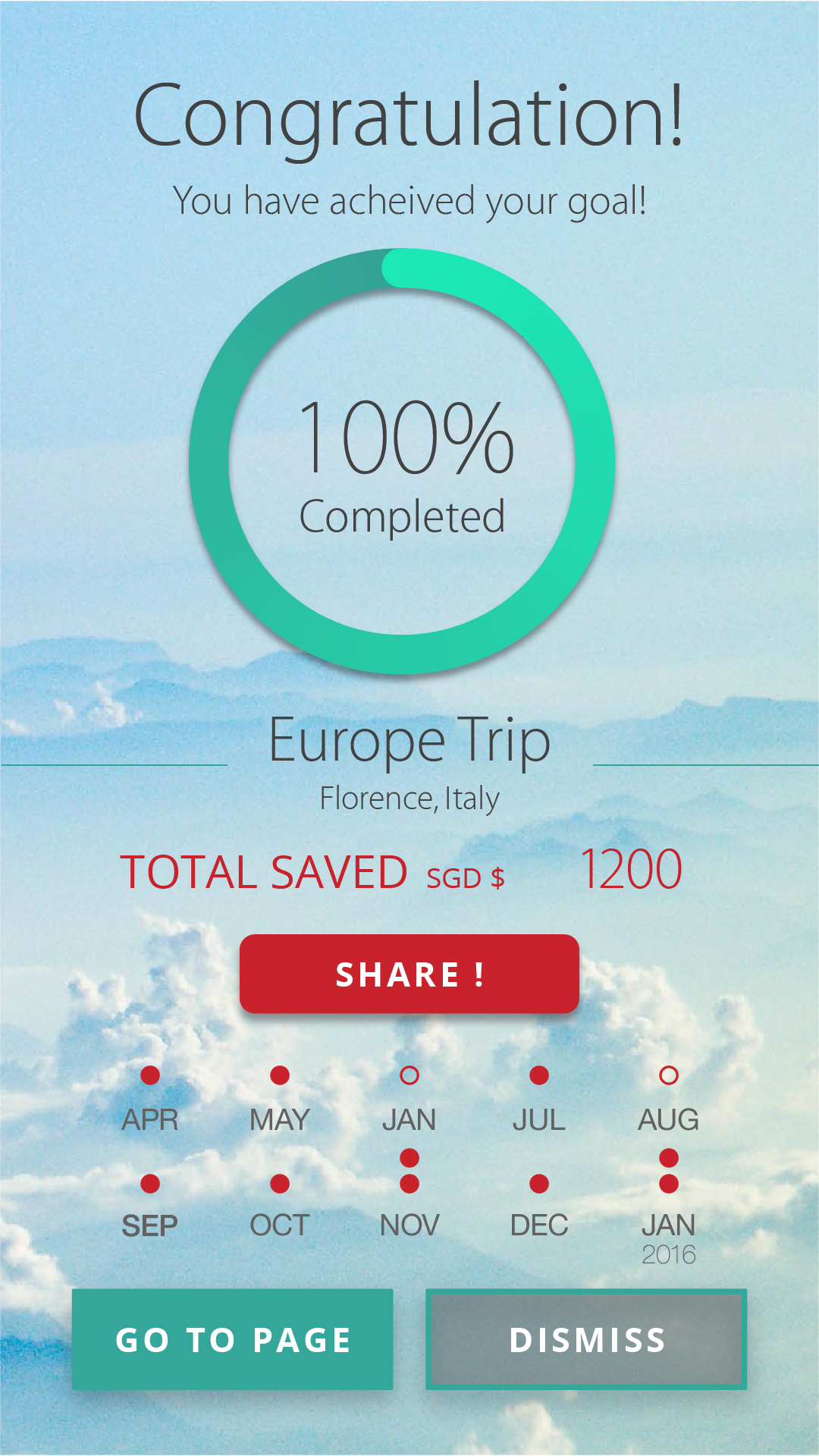

FUTURE BANKING FOR YOUNG WORKING ADULTS

in collaboration with OCBC (2015)

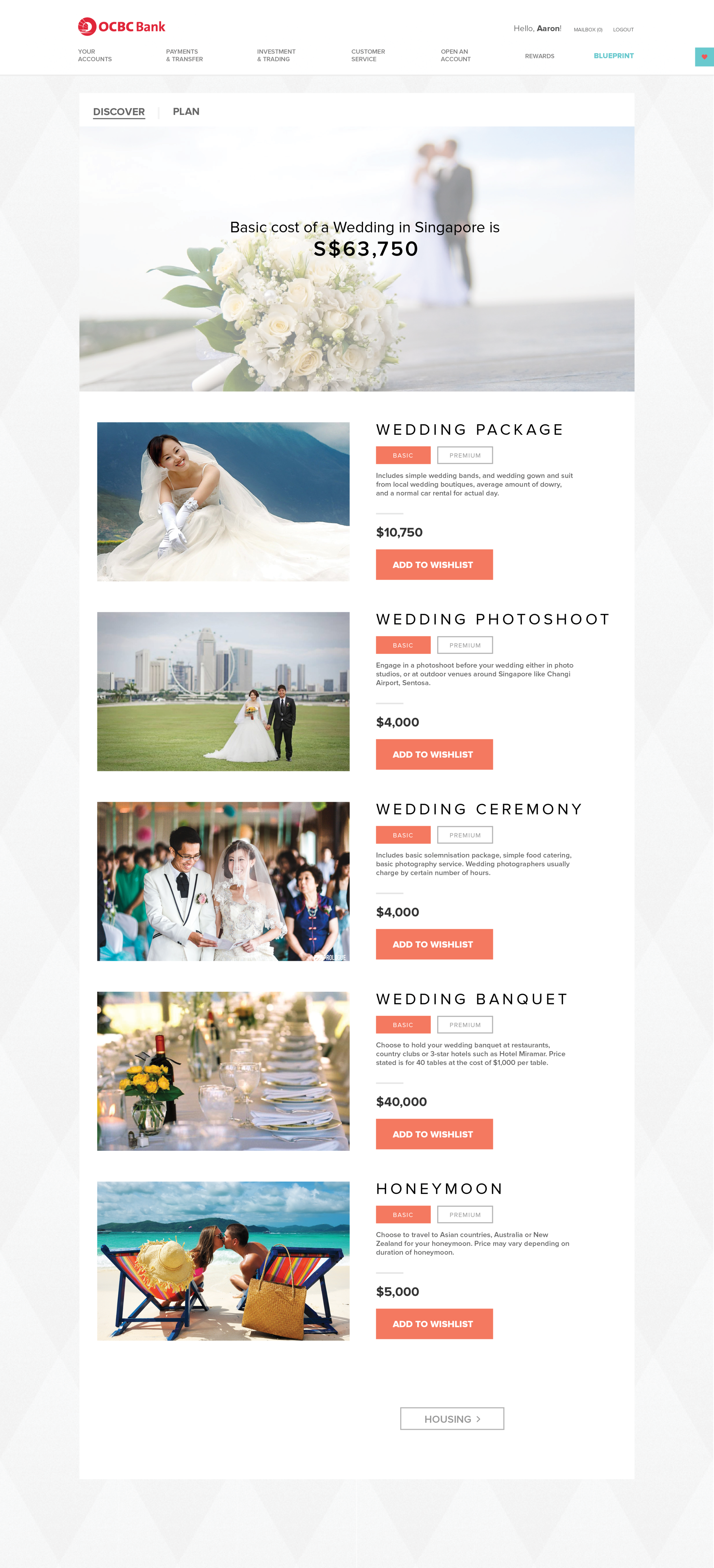

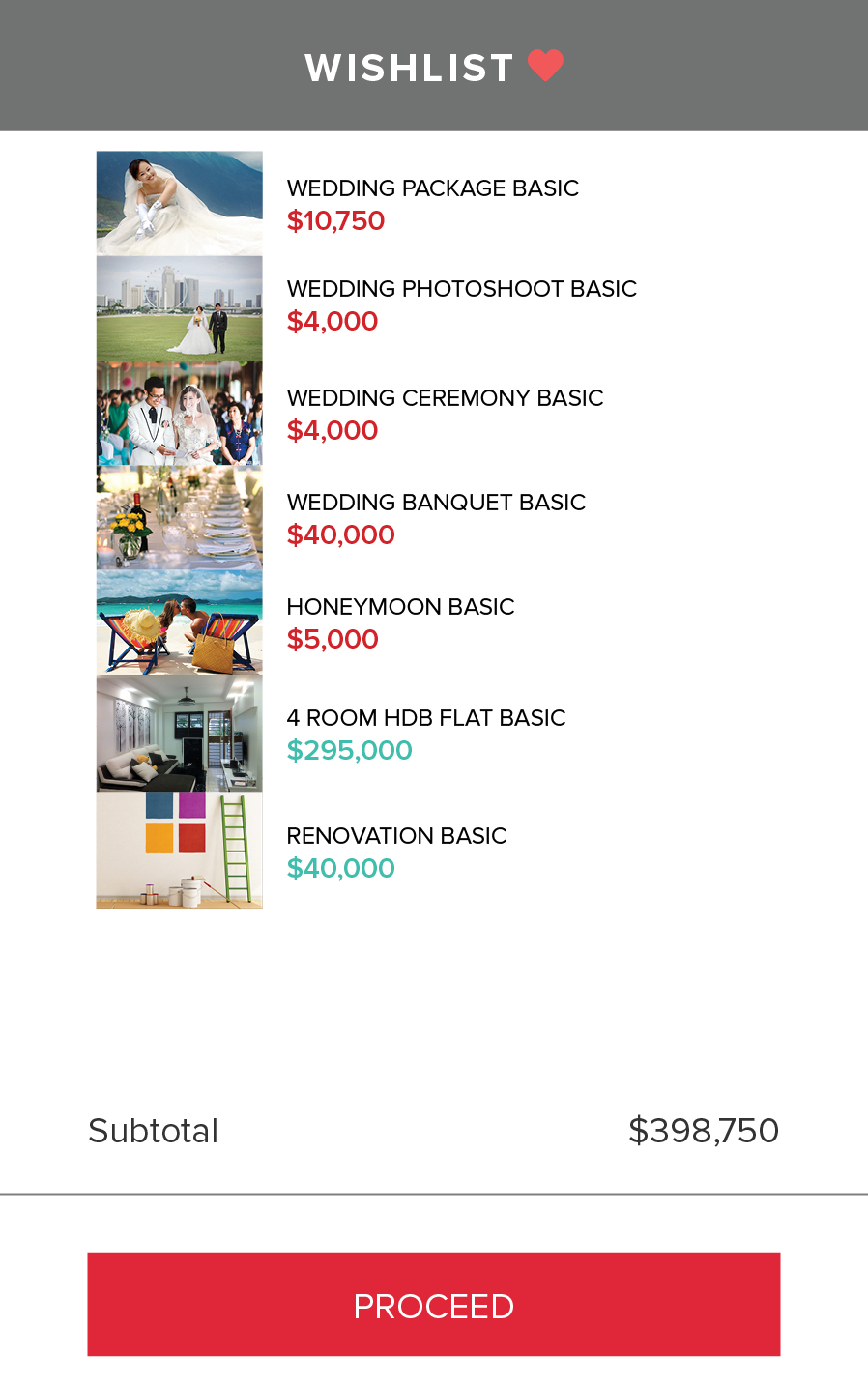

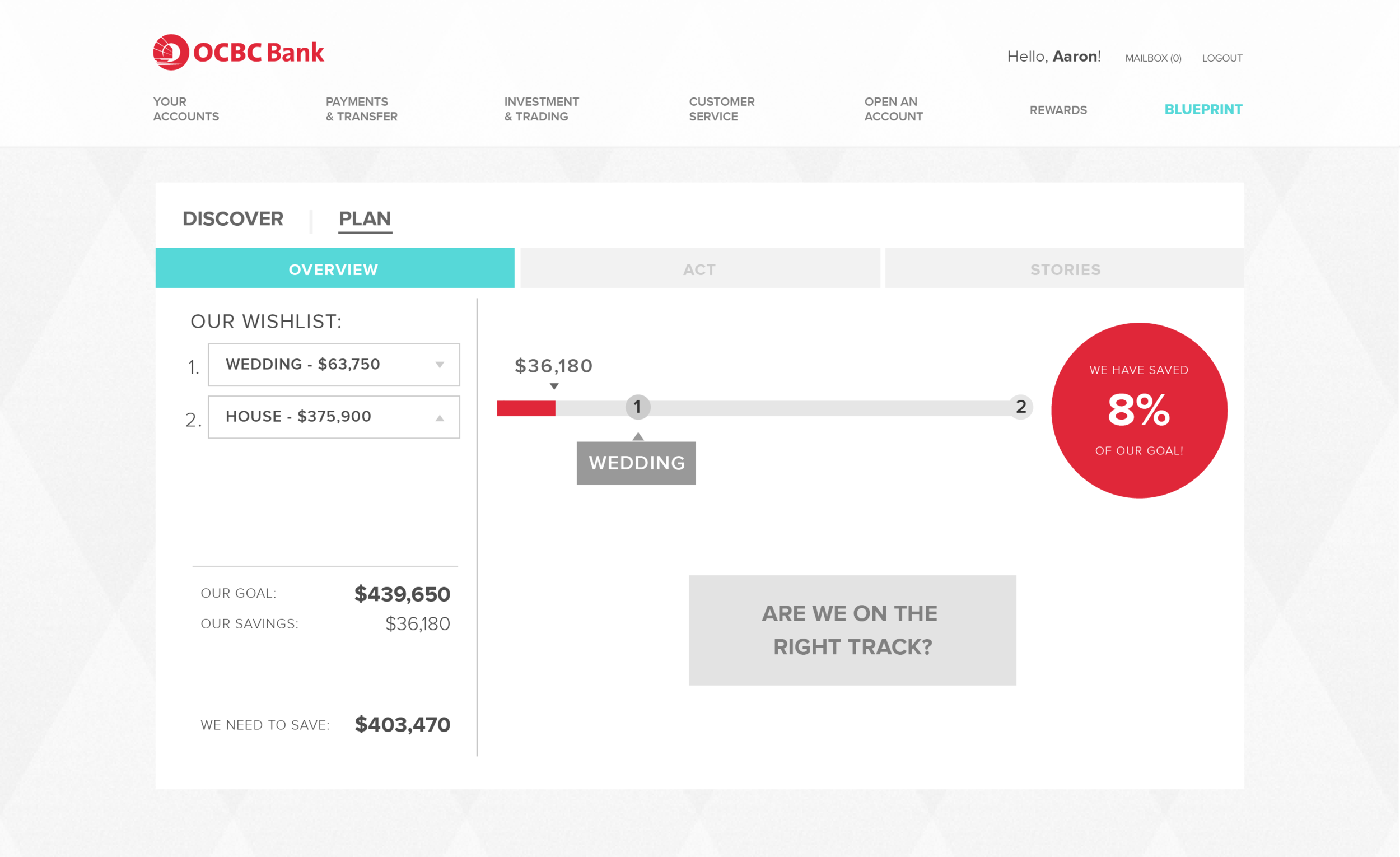

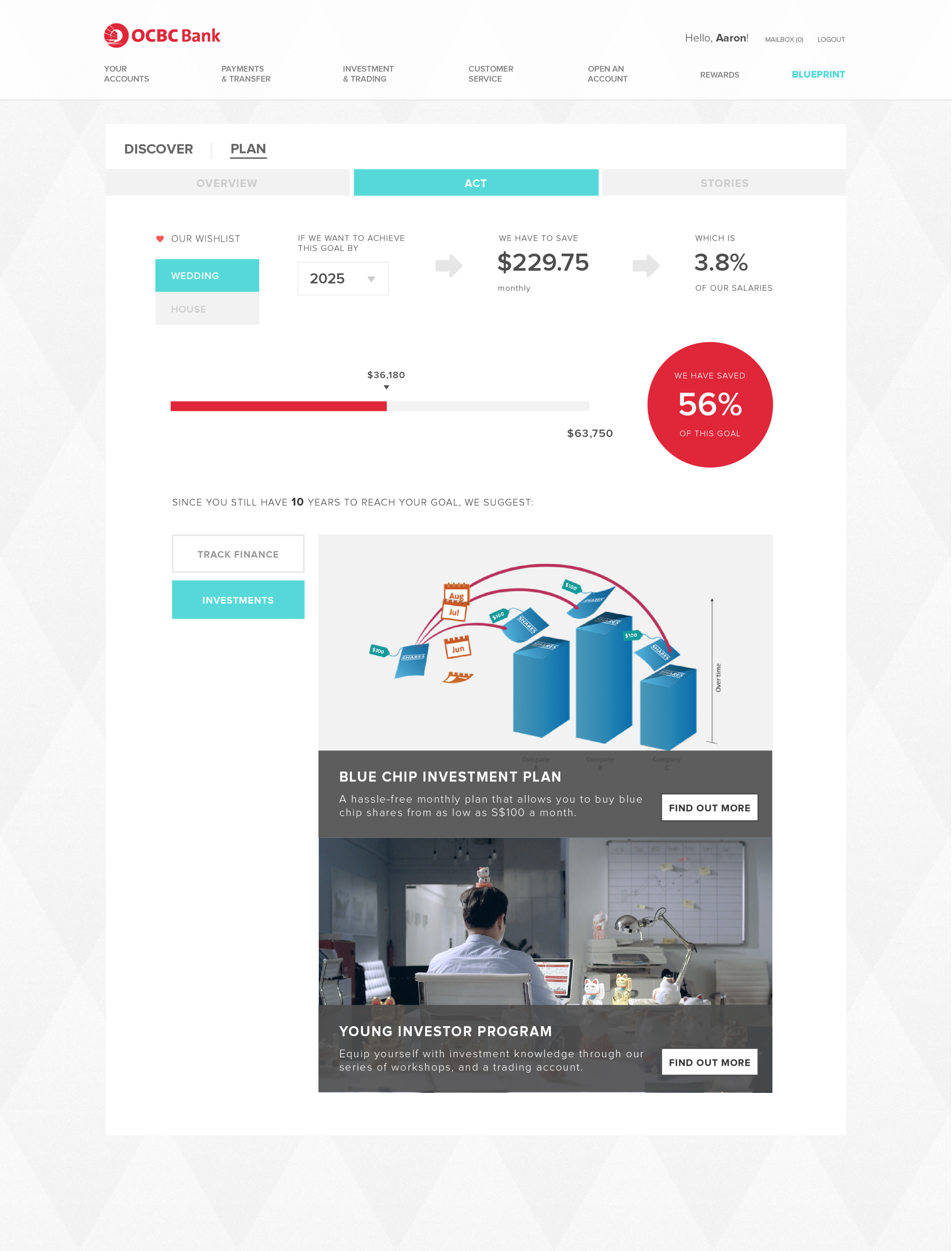

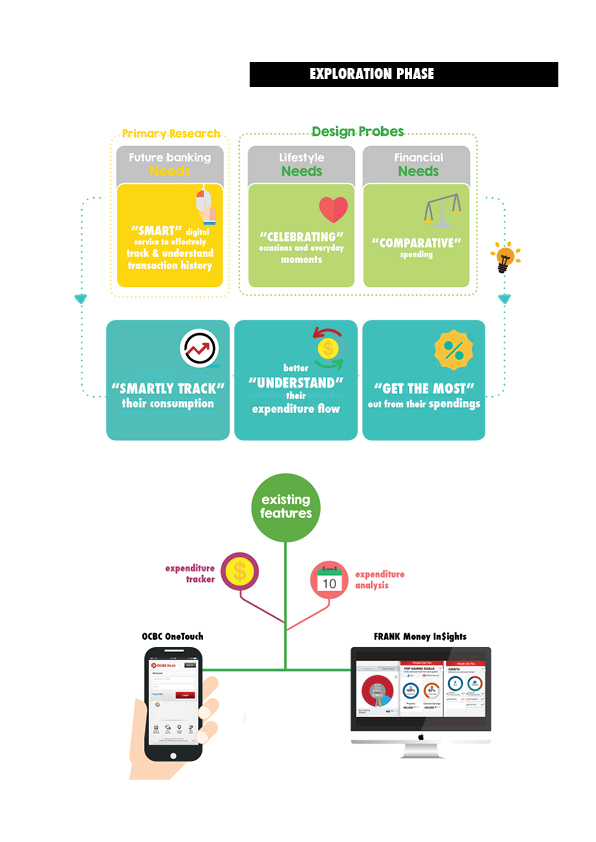

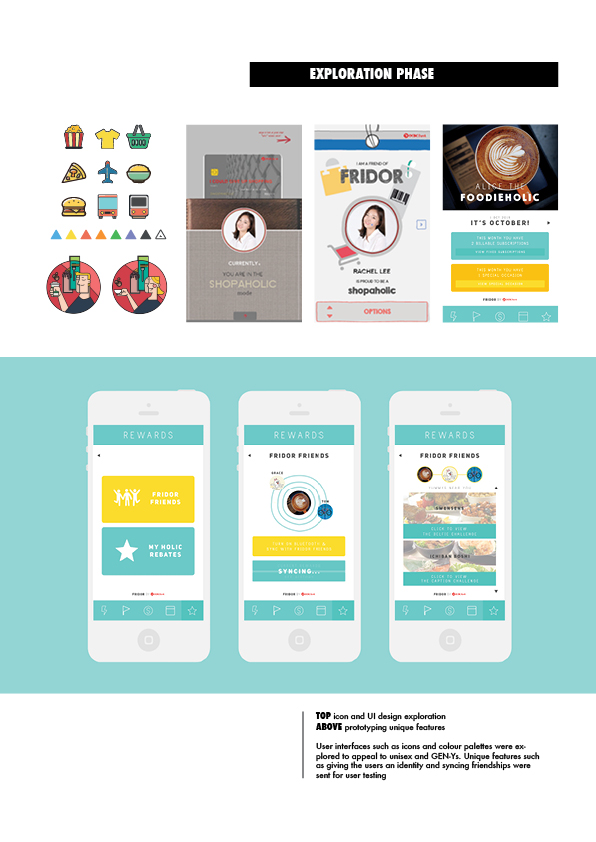

Young adults are increasingly recognised as banks' important future customers. The banking needs of young adults are very diverse and dynamic. They are tech-savvy, and at the same time creating a new digital landscape in the "Internet of Things" era. What would then be the perfect’ banking solutions for young adults? What kind of banking products can really help them to build a better future? What will be the future role of branches for young adults’ needs? How can the service channels be designed for young adults?

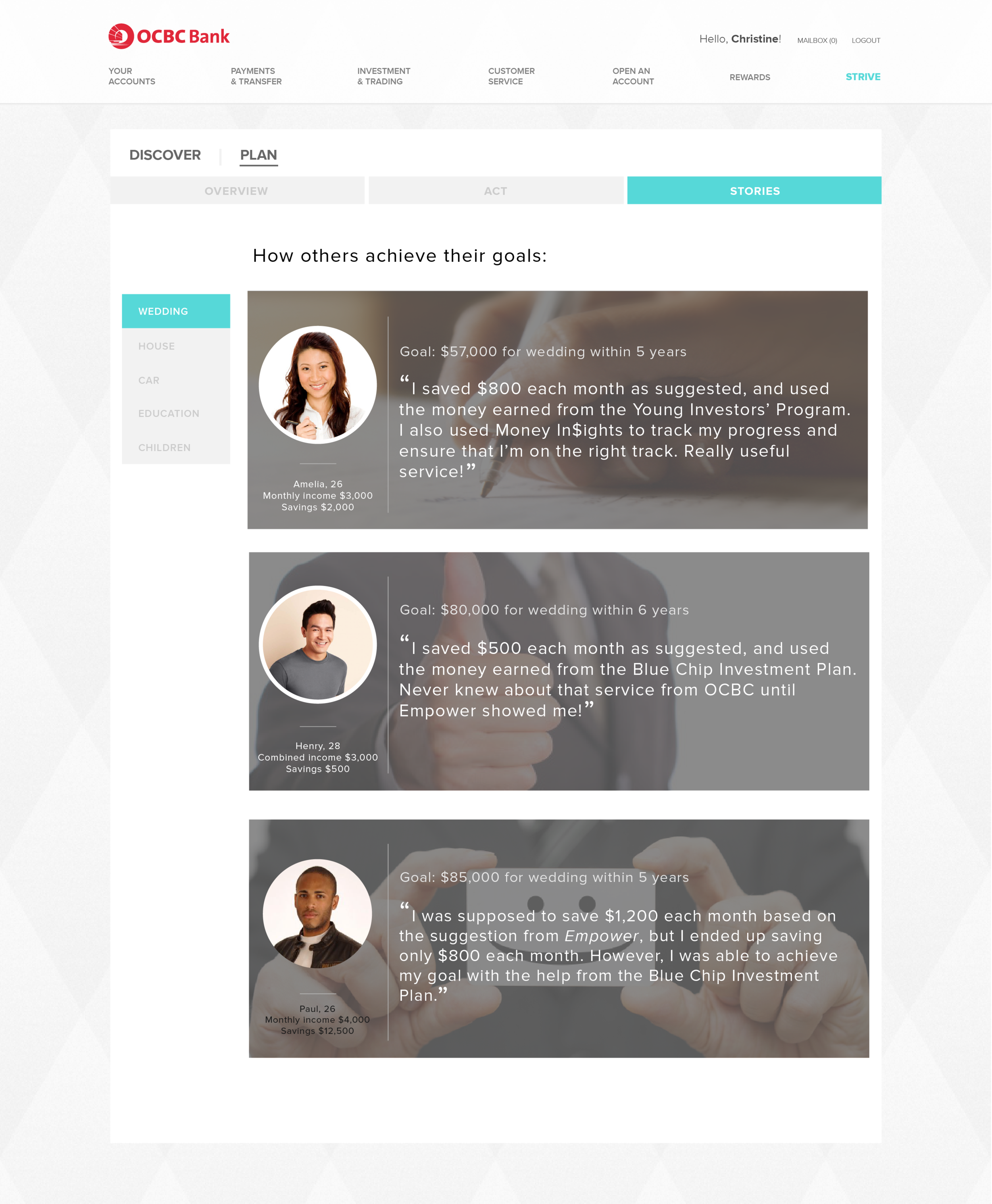

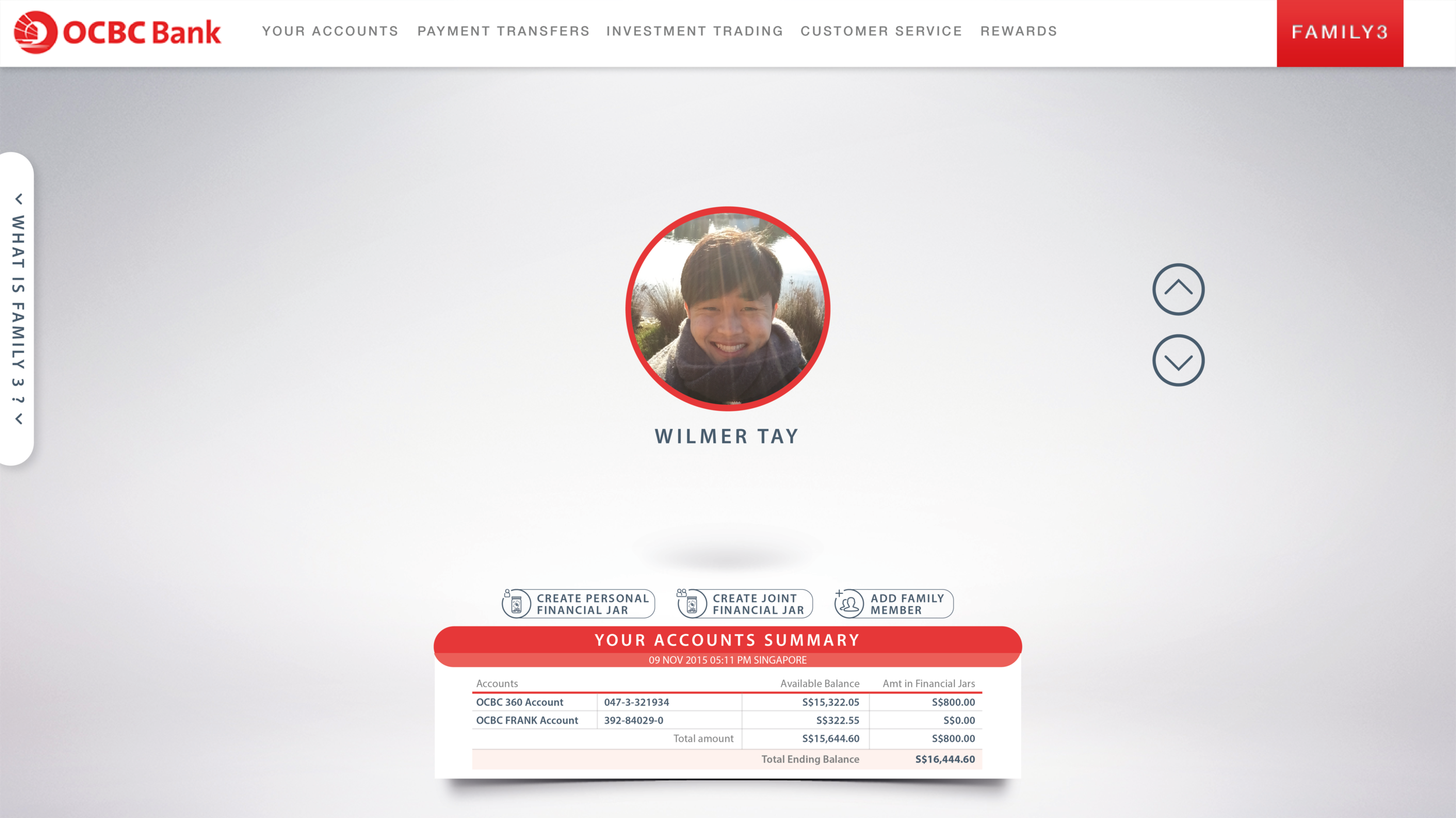

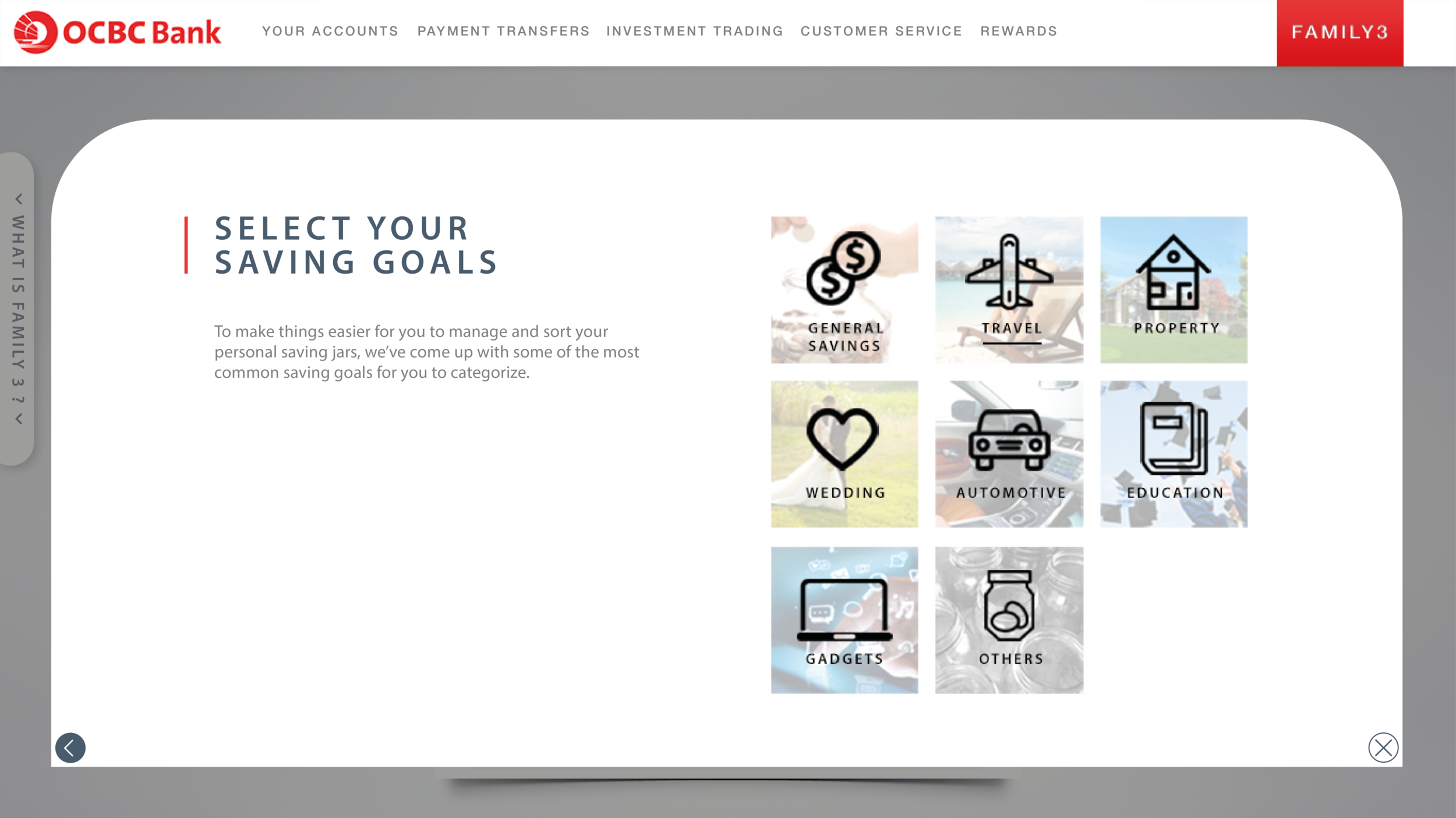

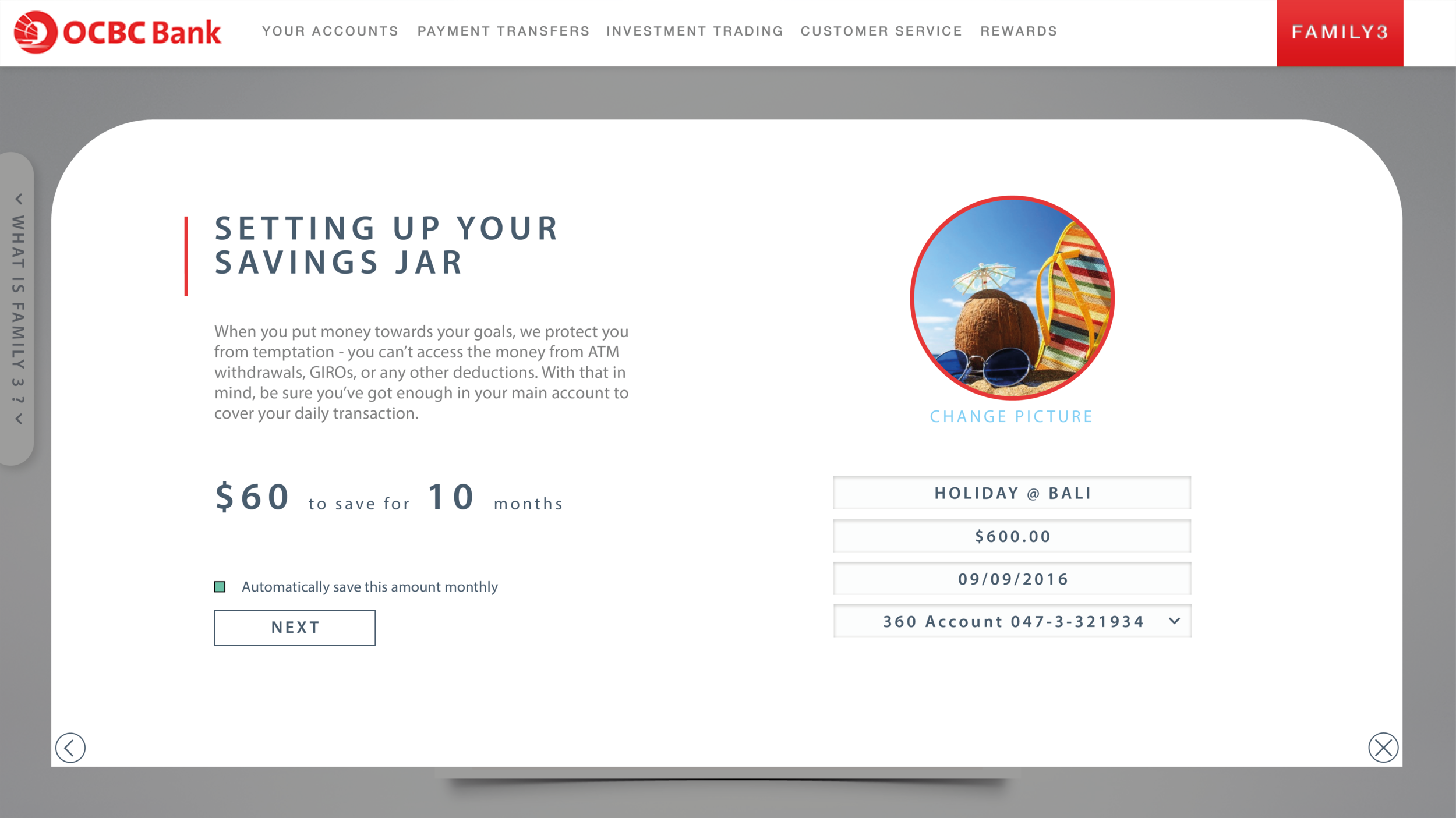

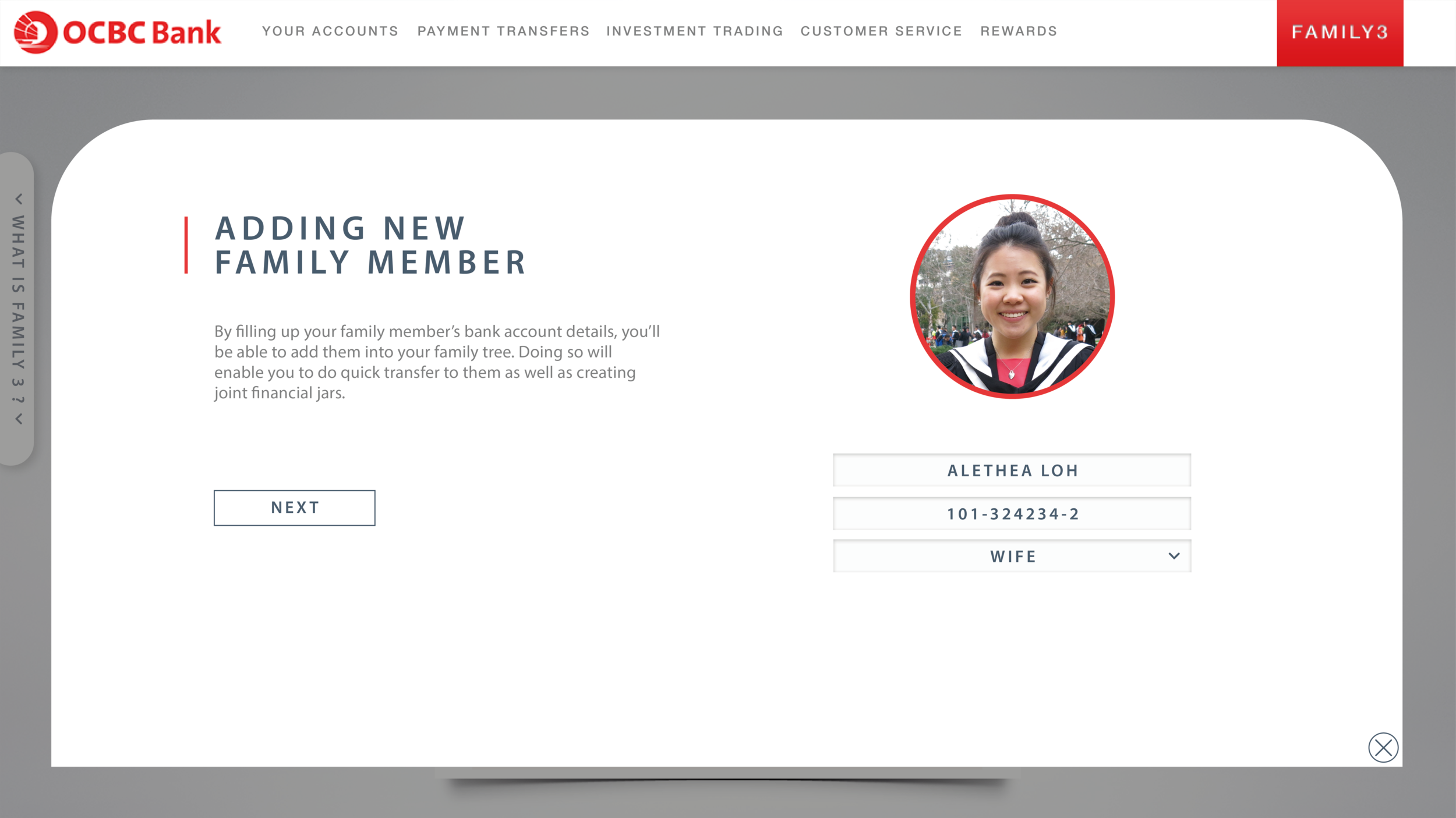

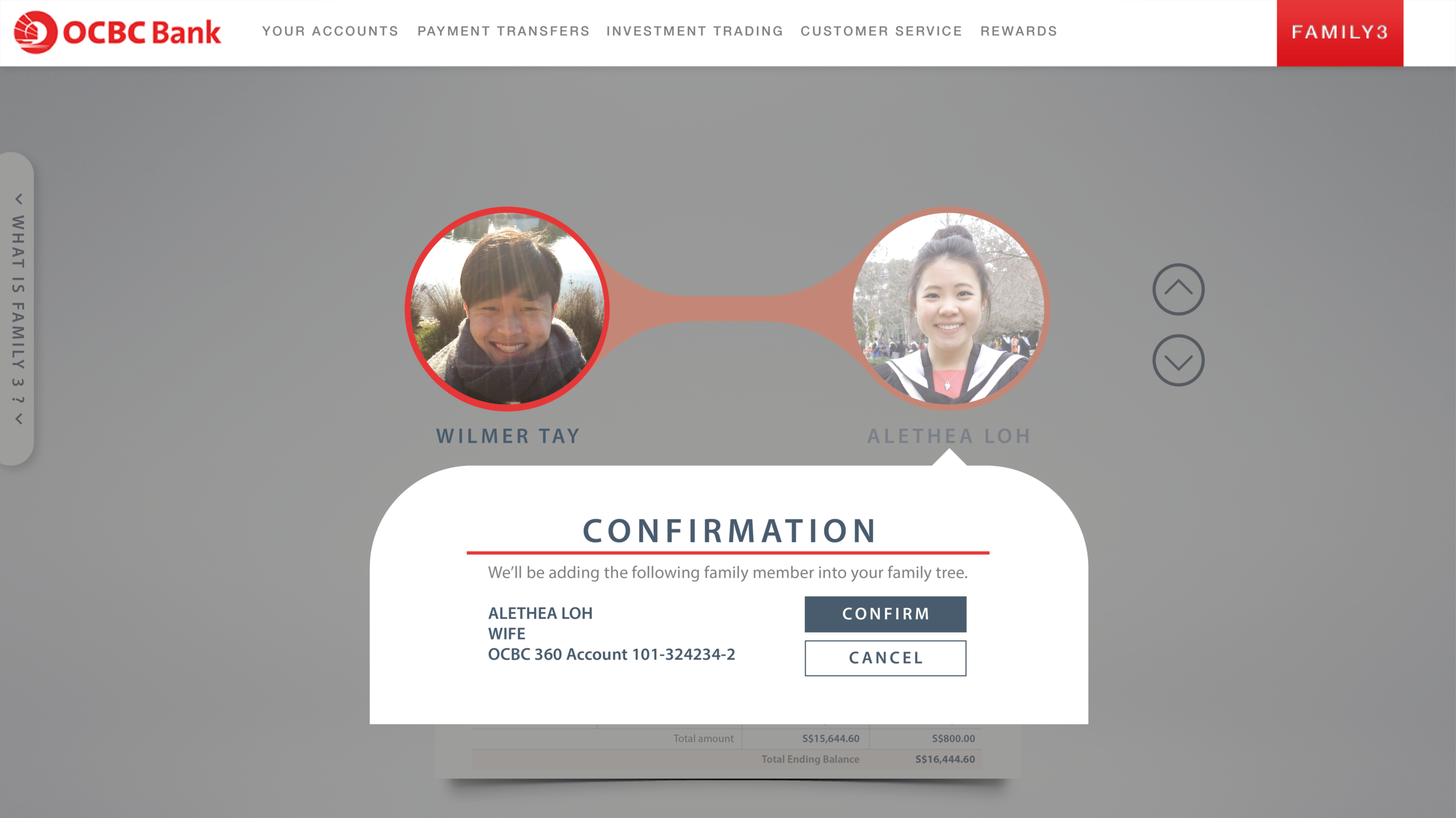

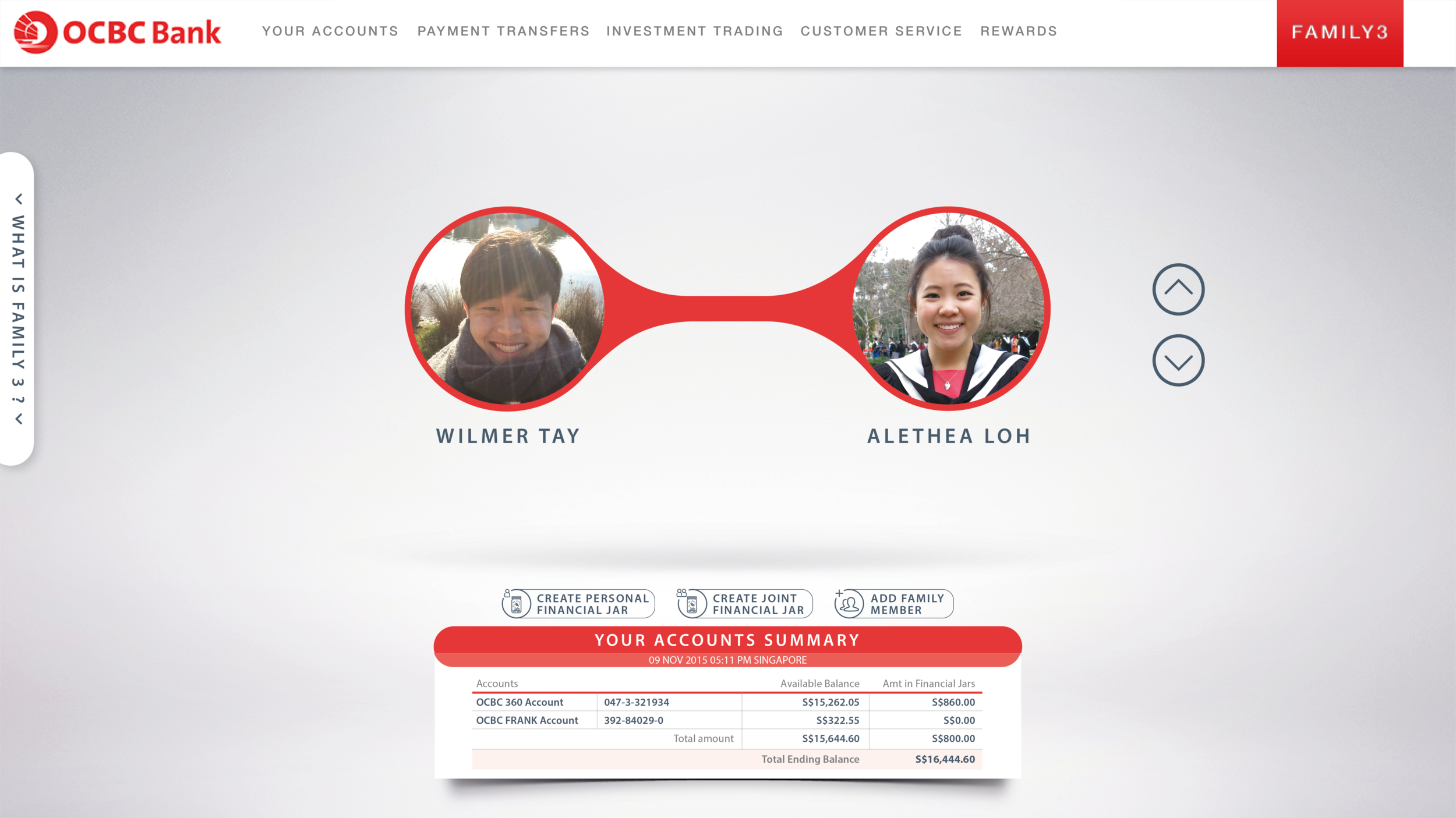

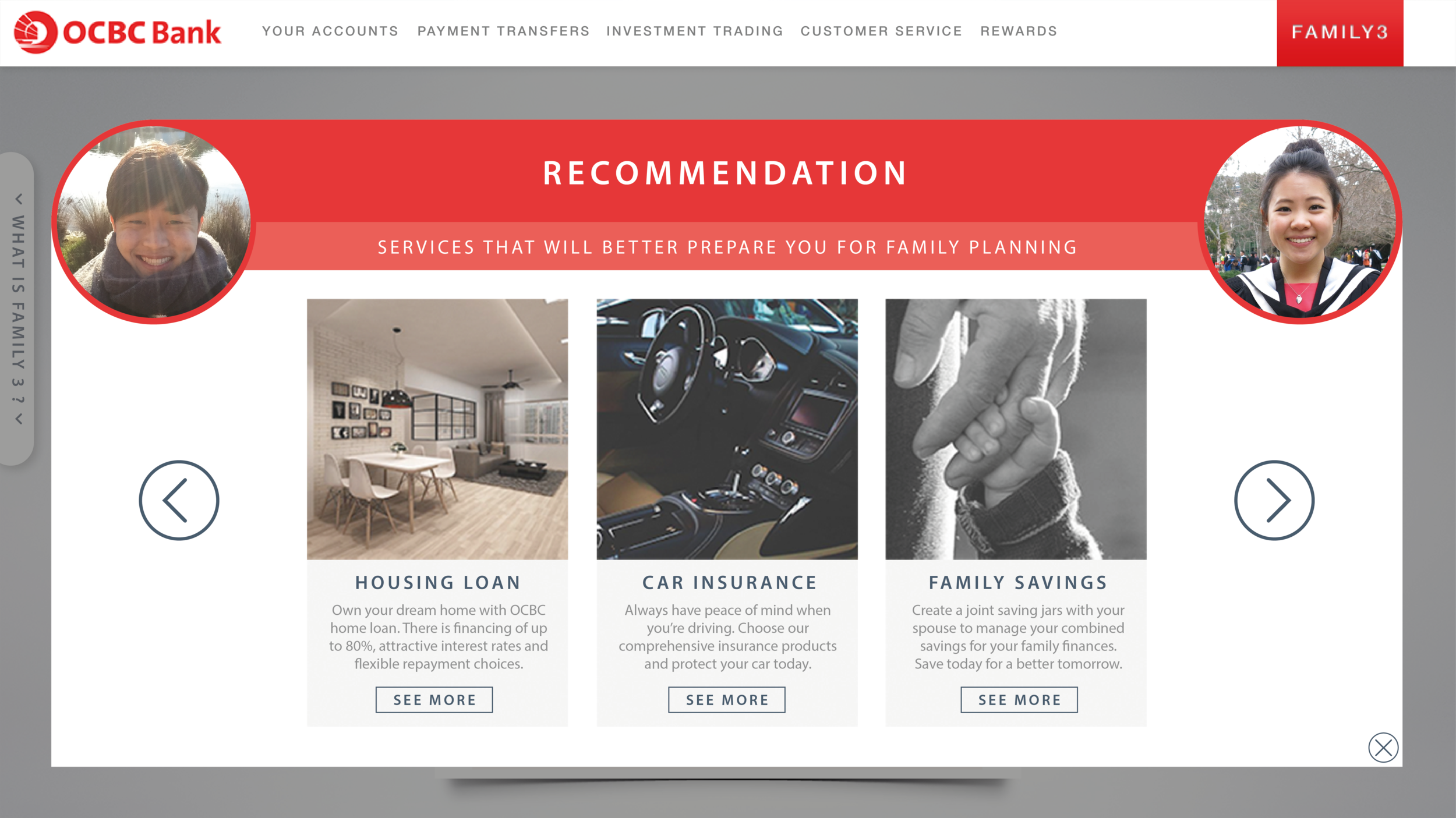

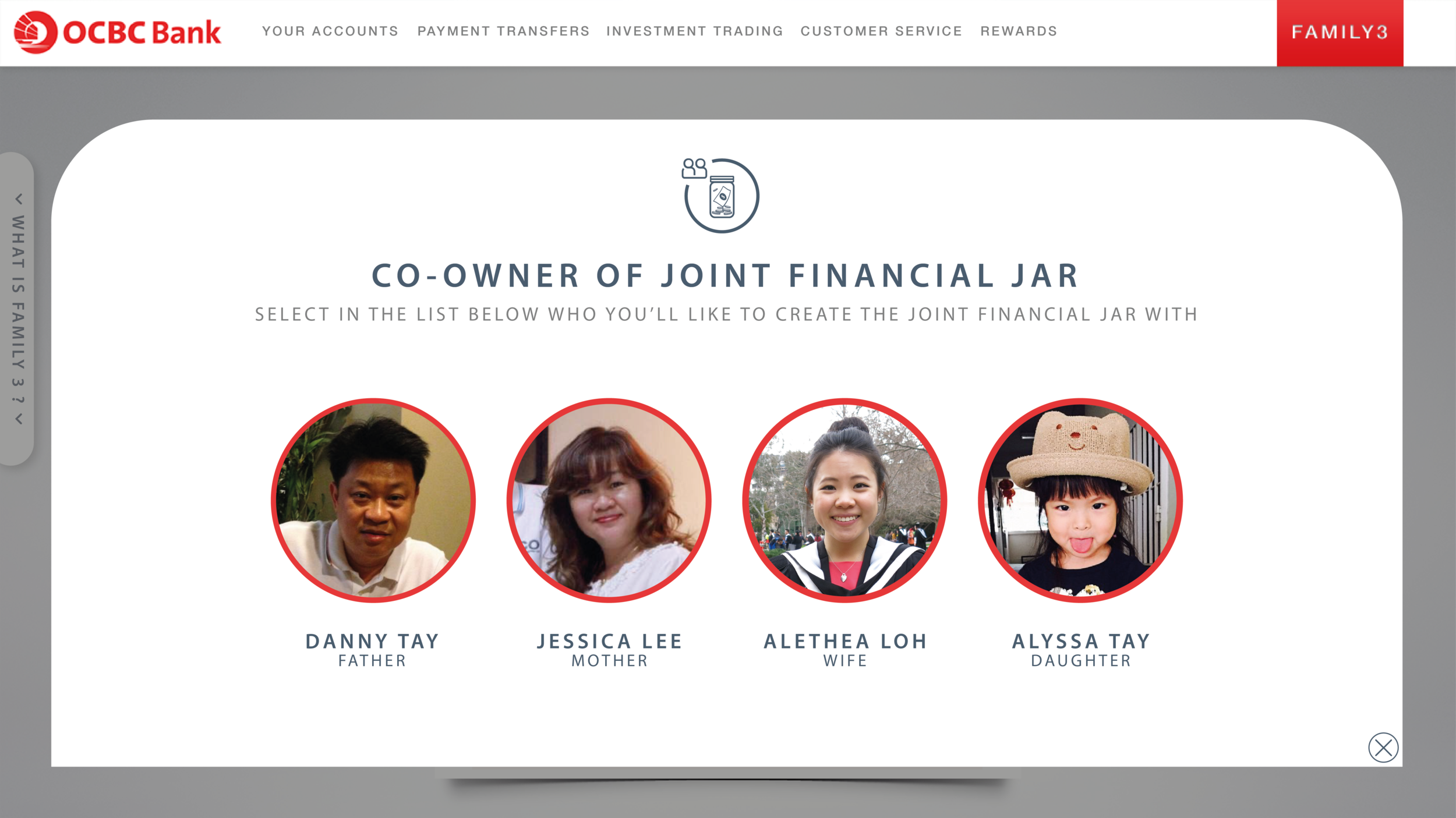

We collaborated with OCBC bank, one of the major banks in Singapore, to explore future banking solutions for young adults. We looked into the eco-system of banking, including digital tools, banking products, social interaction, branches etc.